Introduction

In the digital age, the allure of overnight wealth has never been more tantalising. Scrolling through social media feeds, on TikTok, Instagram or X (Formerly Twitter) you are instantly bombarded with images of luxurious lifestyles, promises of easy money, and influencers flaunting their seemingly effortless riches. These individuals, often dubbed “finfluencers,” or financial influencers tout various strategies and schemes to amass wealth rapidly, portraying themselves as modern-day financial gurus.

However, behind the glitzy facade lies a perilous reality that many unsuspecting individuals fail to recognise until it’s too late. The realm of get-rich-quick schemes peddled by finfluencers is fraught with pitfalls, empty promises, and financial ruin. Herein lies the importance of exercising caution and scepticism when encountering such influencers and their supposed wealth-building strategies.

1. The Illusion of Easy Money

At the heart of the get-rich-quick ethos propagated by finfluencers is the notion that financial success can be achieved swiftly and effortlessly. Whether it’s trading cryptocurrencies, flipping property, or leveraging high-risk investment strategies, these influencers endorse shortcuts to wealth that bypass the fundamental principles of sound financial planning and disciplined investing.

What they often fail to disclose are the inherent risks and complexities involved in participating in such activities. Trading in volatile markets can lead to substantial losses, property speculation can result in financial catastrophe, and high-risk investments may yield minimal returns or, worse, wipe out your savings entirely. The path to true financial prosperity is rarely linear or instantaneous; it requires patience, diligence, and a long-term perspective.

2. The Dangers of Misinformation

Perhaps the most deceptive aspect of the “finfluencer” phenomenon is the dissemination of misinformation and half-truths. In their quest to amass followers and monetise their online presence, many influencers peddle financial advice that is at best misguided and at worst fraudulent. Whether it’s promoting unregulated investment platforms, endorsing dubious products, or cherry-picking success stories to fit a narrative, these influencers prioritise personal gain over the financial well-being of their audience, YOU!

Moreover, the rise of social media algorithms that prioritise engagement and sensationalism only serves to exacerbate the problem. Sensationalist headlines and exaggerated claims capture attention and generate clicks, perpetuating a cycle of misinformation and reinforcing unrealistic expectations.

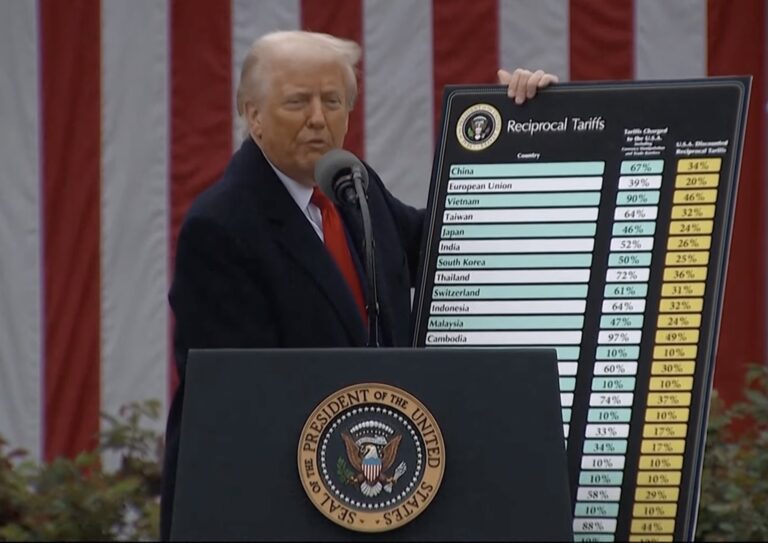

In a consultation paper released in 2023, the FCA discovered that a significant portion of finfluencers’ content, whether in videos or posts, was judged unfair, misleading, or potentially illegal. This is primarily due to the lack of approval from an FCA-authorised individual, raising concerns about the accuracy and legality of the financial advice disseminated through these channels.

3. The Importance of Due Diligence

In an era where anyone with a smartphone can proclaim themselves a financial expert, exercising due diligence is paramount. Before blindly following the advice of a “finfluencer” or embarking on a get-rich-quick scheme, you should undertake thorough research, consult reputable sources, and critically evaluate the credibility of the information presented. Anybody giving advice on financial matters needs to be regulated. Finfluencers are not regulated and there is a fine line not to be crossed when it comes to giving financial advice.

The difference between a finfluencer and a financial adviser is being qualified and regulated and I have yet to meet a industry qualified and regulated Finfluencer! All regulated financial advisers are registered with the FCA, you should always check the FCA register for peace of mind and never be afraid to ask your Financial Adviser for proof that they are qualified, and regulated which means being registered with the FCA and holding industry recognised qualifications for example either DipFA or DipPFS.

With all the videos and posts on social media from finfluencers, it’s essential to maintain a healthy scepticism and be wary of promises that sound too good to be true. True financial success is built on a foundation of education, prudent decision-making, and adherence to time-tested principles of wealth accumulation. There are no shortcuts or quick fixes when it comes to building sustainable prosperity.

Conclusion

While the allure of get-rich-quick schemes propagated by finfluencers may be enticing, the reality is far less glamorous. Behind the veneer of luxury and opulence lies a landscape rife with risk, misinformation, and financial peril. Aspiring investors would be wise to pay attention to the cautionary signals and approach such influencers and their schemes with caution and scepticism.

True financial success is not found in overnight windfalls or speculative ventures but rather in disciplined saving, prudent investing, and a commitment to long-term wealth accumulation. By prioritising education, diligence, and informed decision-making, you can safeguard yourself against the pitfalls of get-rich-quick schemes and chart a course toward lasting prosperity. Talk to a regulated financial adviser, we have the industry recognised qualifications as well as being regulated by the FCA and we are not obsessed with gaining followers and fame over responsibly guiding you in delivering sound financial advice.